Our home equity line has many unique advantages:

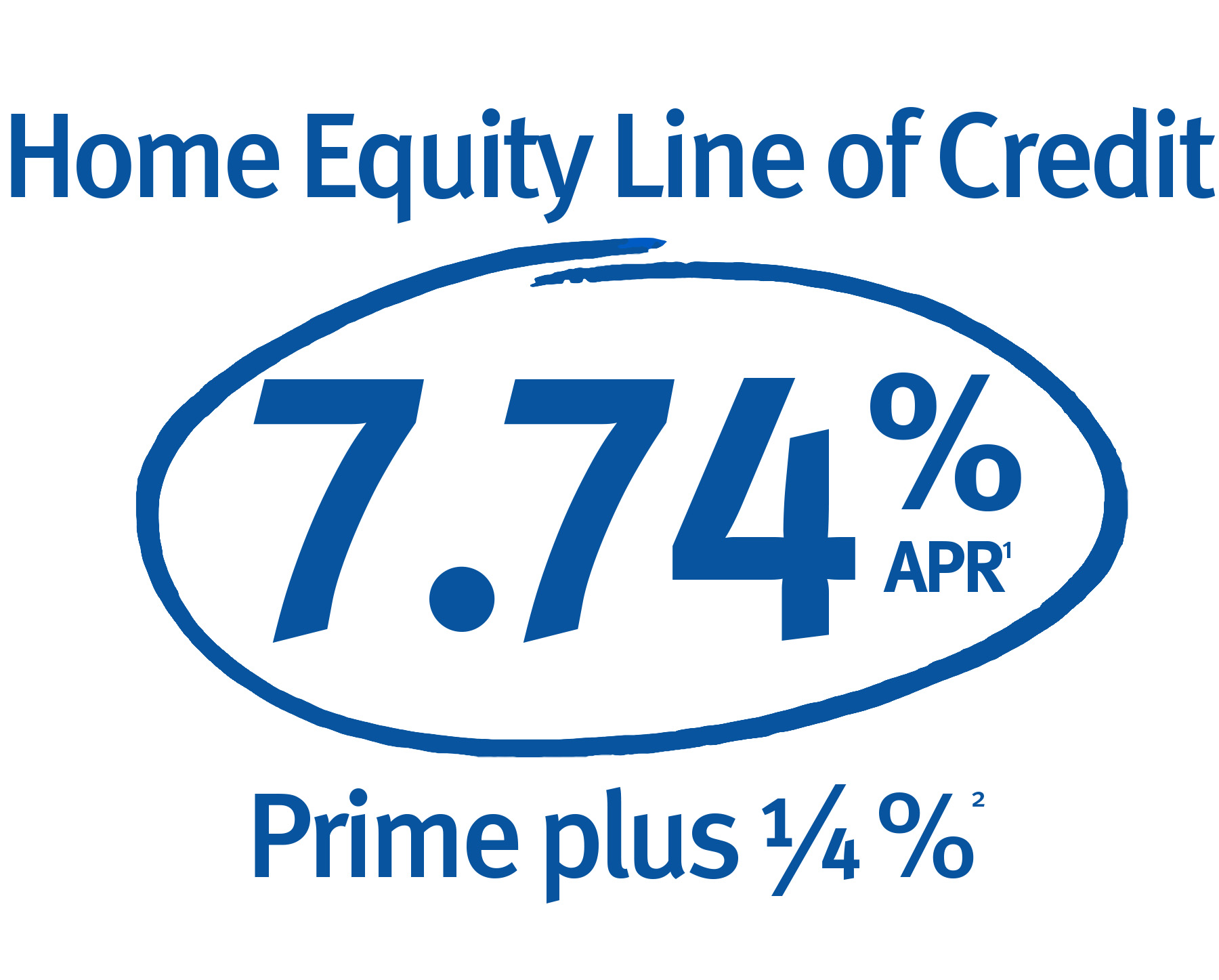

- Low rate — only prime + .24%2

- No closing costs

- Deduct 100% interest from taxes3

- Close in 3 weeks or less

- No minimum draw requirements

- 10-year draw period

- 20-year repayment period equals lower monthly payments

- Check writing and debit card access

A home equity line of credit is a variable-rate loan usually tied to the Wall Street Journal Prime Rate. Lines of credit have a draw period, usually 5 to 10 years and a repayment period, usually 10 to 20 years. Home equity lines give you the flexibility to borrow funds up to your credit limit. Use your home equity line of credit for any expenditure, not just home improvements and you can access your home equity line whatever you need to.

Accessing your funds is as easy as writing a check or using your debit card. You only pay interest on the money as it is borrowed. Once the money is paid back, you may borrow the funds again. The draw period for our line of credit is 10 years during which you may borrow on the line and pay it back as many times as you like. Just like a credit card, you will receive a bill each month for the minimum monthly payment, based on your outstanding balance. When your 10-year draw period is over, the 20-year repayment period begins on the remaining balance.

Home equity lines are a great tool when you are uncertain of how much borrowing you will need, or you anticipate having to borrow more funds in the future or for projects like remodeling or tuition, that have multiple payments phased in over time.

Rate effective 1/30/2025 and are subject to change. 1Annual Percentage Rate (APR) of 7.74%, is the Wall Street Journal's current Prime Rate, presently 7.50% 2plus .24%. Home insurance required. Flood insurance required, if applicable. Maximum APR 18%. Minimum loan amount is $10,000; $15,000 for NC. Maximum loan amount is $300,000. 30-year term. An Equity Passport HELOC (Home Equity Line of Credit) is available as a first or second lien on owner-occupied primary residences and can be the only HELOC on your property. Annual fee is $95. Minimum monthly payment is $100. Borrowers are responsible for all taxes including transfer tax, doc stamps, intangible tax, recording tax and mortgage tax, if applicable. Taxes are paid through the line at the time of closing. 3Consult tax advisor on tax deductibility. Loans are underwritten, processed, and serviced by Equity Passport a division of Mortgage Passport. ©2025 Mortgage Passport a division of Third Federal. NMLS ID#449401